The construction accounting process is a system of tracking payable invoices, accounts receivable, payroll, and producing financial statements. Keeping everything organized can be a bit scary, but with the use of a good construction accounting system and support, you can have a productive system.

THE ACCOUNTING SYSTEM

Many look at the accounting system as pure overhead. Your accounting system should be another tool in your toolbox providing you with detail costs, allowing better management of projects.

Any accounting software package can record invoices. Write checks to pay these invoices. Generate receivable invoices and track the payments from your clients for these invoices. Calculate payroll for employees and create all the required reports, including writing checks through printing W2’s at year end. Some generic, lower-cost programs fall short in areas that are at the heart of the construction business.

The accounting system must have a solid audit trail for every accounting entry that is made in the system. Most systems that are endorsed by CPA’s have this and do not allow the users to go back and change entries without a trail to follow. When you produce financial statements, you must have the ability to prove every number you produce.

KNOW THE RULES

There are rules that you should follow for construction accounting. For example, your job cost detail for the year should be equal to your job cost general ledger accounts. This is a task that every auditor will check. A good system forces you to keep these in balance.

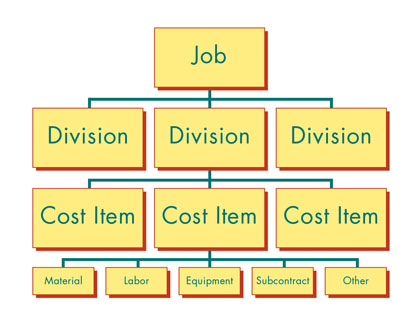

Your accounting system must have job cost. Job cost should provide detail job cost by line item of the job. We often refer to these as Divisions and Cost Codes. Masonry would be a division and would have cost codes for Brick, Block, and Stone, for example.

The cost system should provide detail cost for each cost code. In other words, if you have five invoices for brick material and two invoices for a subcontractor, all seven invoices should be listed in the cost. The cost system must also track cost compared to an estimate per line item. Some systems allow project managers to project cost at completion.

VITAL SYSTEM FEATURES

Your construction accounting system should have contract management for subcontractors and material purchases. Contract management should contain the original contract with any change orders to the contract. When payable invoices are entered into the system, the system should update contracts, determine if the invoice is over the contract amount, verify the status of insurance certificates, and generate a lien release for each invoice. If the invoice is over the contract amount or fails the insurance test, the invoice should be held for payment until the reason for the hold is determined. Management of contracts to subcontractors is one of the more critical tasks required and your accounting system should assist in this process.

THE MONEY FACTOR

Overpaying on contracts is often difficult to impossible to recover. Discovering during your annual audit that a subcontractor’s workers’ compensation insurance expired right before the job started because he “just could not afford it” is an additional cost for you. Your accounting system should have warned you.

Payroll should be posted to projects for the hours that apply to the project. You must be able to charge multiple jobs and multiple line items for the pay period. Not only should the labor be posted to the cost but to the specific line item of the job. For example, you may have an employee that does rough carpentry and concrete form work in the pay period. The actual payroll overhead should also be posted to the job. This should be a direct function of the accounting system.

Payroll overhead not only consists of the company’s share of FICA, Medicare, Federal, and State Unemployment, but also Workers’ Compensation, General Liability, and Excess Liability insurance.

The payroll system should have the flexibility to allow an employee’s time within a payroll to be assigned to several workers’ compensation codes determined by the task of the employee. Your system should be able to generate workers’ compensation reports that are detailed for these assignments. These reports make the worker’s compensation audit a snap.

Company equipment should be tracked just like payroll. When equipment is used on the job, it should be charged to that job. If you are a site work contractor, up to 40 percent of your cost of the project could be company equipment.

OPT FOR INDUSTRY-SPECIFIC

There are several options for a construction accounting system. These range in price from $3,000 to more than $100,000. The biggest mistake a construction company can make is purchasing a software package that is not industry-specific. If the software can account for a construction company, beauty shop, and the local bar, then it’s lacking the tools that you need to operate your construction business.

Your support should be someone who knows the construction industry. Many of the construction specific packages have persons assigned to your account for support. You generally have to pay a monthly or annual support fee.

Don’t think of the accounting system as just overhead. The accounting system should be an integrated part of your company. It must provide you with the financial and project management components required for your company to be successful. ■

For More Information: In business for more than 30 years, Software Constructor is a construction accounting software company providing a fully integrated construction accounting system called Accounting 4 Construction. For more, call 615.351.0916, or visit www.accounting4construction.com.

_________________________________________________________________________

Modern Contractor Solutions, August 2015

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Contractor Solutions magazine.

Net Present Value